How to Get a New Mortgage, Even with Bad Credit

Are you a Home Buyer or Homeowner sitting on the fence because your credit is not perfect?

Are you a Home Buyer or Homeowner sitting on the fence because your credit is not perfect?

Would you like to purchase a home or refinance your current loan at today’s low interest rates?

Good news, you are in luck.

Many of our new mortgage programs allow bad credit.

With lower credit score requirements (down to 580 credit scores) and shorter waiting periods since major credit events like, bankruptcy, foreclosure and short sales, we are obtaining more and more loan approvals.

I know what you are thinking… you must need a large down payment or a lot of equity to qualify with bad credit, right?

Wrong. These programs allow for a less than 5% down payment or equity in the property even for credit scores below 600!

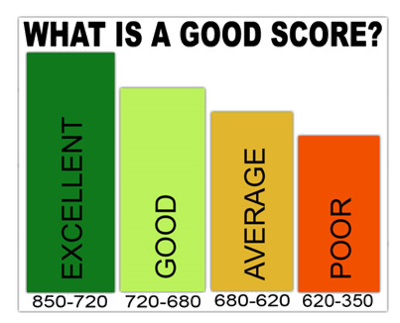

According to Experian, in 2020 the national average Fico credit score was 711. So, you can have a score well below the national average and still get approved for a mortgage with these new programs.

Here is the catch. The big banks don’t like these loans. Most big banks have minimum credit scores of 720. They set their credit standards high so it appears to the regulators and shareholders that they are lending only to those who represent a very low credit risk.

But, there are companies, like ours who represent some of the largest wholesale mortgage banks in the nation that love these loans, even specialize in them.

Let’s do the math. You don’t need excellent credit, a big down payment or large amount of equity to qualify.

So what are you waiting for?

Are you ready to see what these new mortgage programs can do for you?

Call 800-607-1941 x220.

Posted by: Brian Bush

Posted by: Brian Bush

Brian and his team have been funding Home Loans for over 28 years.

Since 1991, they have funded over 3,000 loans

See Brian’s Reviews

You can reach Brian at 800-607-1941 x220 or bbush@slglends.com