by Brian Bush | Feb 1, 2021 | Alternative Loan Programs, Bad Credit Mortgage, Mortgage Pre Approval, Residential Lending

Are you looking to make your first home purchase, but worried that your credit may stop you? Well, you are not alone. You are not the only first time home buyer with bad credit. Most new homeowners using our loan programs have had some credit issues. Reduced credit...

by Brian Bush | Jan 22, 2021 | Alternative Loan Programs, Bad Credit Mortgage

Are you looking for a new mortgage but concerned about a recent bankruptcy? Well, the good news is, that a recent bankruptcy’s impact on your credit will diminish over time…but you probably already knew that. When will you be able to get back into the home mortgage...

by Brian Bush | Mar 20, 2018 | Alternative Loan Programs, First Time Home Buyers, Program Updates, Residential Lending

Looking for a First Time Home Buyer Down Payment Assistance Program? The good news is that our First Time Home Buyer Program allows you to put zero down. That's right, 100% financing for the purchase of your new home. And,...

by Brian Bush | Apr 4, 2016 | Alternative Loan Programs, Guidelines, Qualifying, Residential Lending

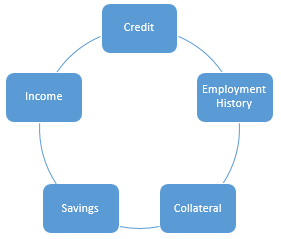

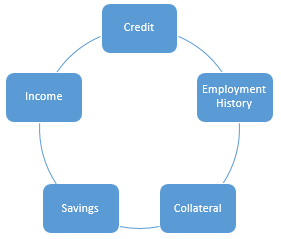

When qualifying for a home loan, lenders focus on five main areas of the application. Although each lender may have its own preferences, they all have very clear written guidelines as to what they will and will not accept in these areas. The five main qualifying...

by Brian Bush | Dec 2, 2014 | Alternative Loan Programs, Qualifying, Residential Lending

All government, conventional and jumbo loan program guidelines require that the borrower have the ability to repay the loan. Income qualification is one of the five main home loan qualifying factors. Click to see today's rates Underwriters, who work for lenders as...