Sure mortgage rates are quoted everywhere, but what you don’t know about what is behind the quoted rates could hurt you.

By law, the Annual Percentage Rate (APR) must be disclosed and this is a common and simple way of comparing one lender’s mortgage rate quote to another’s. The APR is supposed to factor in some of the other costs required to obtain the loan in addition to the interest paid on the principal amount you borrow. So, the interest rate, which the lender will be collecting on a monthly basis along with some of the other costs to obtain the loan will be expressed as a percentage, which is the APR.

When calculating the APR, lenders are only required to include certain prepaid finance charges. Are there other fees associated with closing a mortgage loan? You bet there are!

When shopping around for the lowest mortgage rates, focus on the following three areas so you can accurately compare each loan option:

- All of the costs and fees associated with each loan (not just APR fees)

- Advertised rate assumptions (teaser rates)

- The variables that determine the actual rate you will qualify for

1. The Total Costs and Fees

To be honest, the current required Good Faith Estimate is still confusing to most borrowers as it puts the fees in groups and spreads them out over two pages. In fact, I have found very few who prefer it to the old version which is a simple list of all fees associated with the loan on one page.

Most borrowers like to see a simple list of the total fees that they will be required to pay and what the interest rate and the total monthly payments will be including principal and interest, property taxes, homeowners insurance, mortgage insurance (if any) and association dues (condos an PUDs).

Make sure to ask for this simple list of fees. Although not a required disclosure, every loan officer should have this form, it’s called the “Fees Worksheet” (sample below), aka “the old GFE” to us old-timers. This is one of the single most important documents you need to get upfront, keep and bring with you to closing. If your loan officer will not provide this, find a new loan officer.

See Sample Fees Worksheet Below

2. Advertised Rate Assumptions

Have you ever seen an advertisement for a car where the price seemed really low, then in fine print at the bottom, it says “only one at this price”? As my car salesman friend, Bob once told me these cars were stripped down, had only the bare, basic features, and were known as “strippies”.

Advertising for current mortgage rates is not much different, when quoted rates require a credit score much higher than what the average American has. While there are probably plenty of funds available at the advertised rate, do you know what the qualifications are to actually get that low rate?

Often, if you dig around a little, you can find some of the basic assumptions made by the lender when preparing the advertised rate quote. Generally, the lowest possible rate that will be quoted assumes that you have excellent credit and a very large down payment or a lot of equity in your property and the loan will be for a single family home that you occupy.

All lenders use rate or “price adjustments” to offset the risk of lending to those who do not have excellent credit and a lot of equity or a large down payment. The basic price adjustments are for a combination of credit score and loan-to-value. There are many other adjustments that may also apply, depending on other characteristics of your loan (i.e., rental property, second home, 2-4 units, cash-out refinance, etc.).

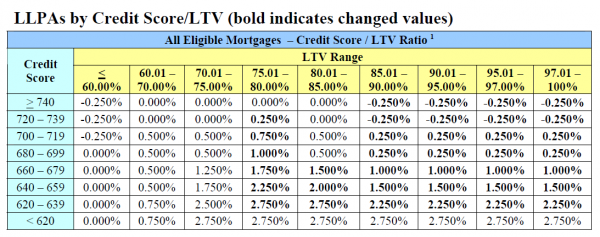

Here is Fannie Mae’s chart that most lenders use:

The amounts listed above are additional fee amounts, which are normally added back into the rate and cause an increase/decrease in the actual interest rate.

According to Yahoo Finance, the average American’s credit score in April of 2014 was 692. On this chart, an individual with that score would need to have an LTV (loan-to-value) of 60% or less to avoid a price adjustment. Meaning they would need a 40% down payment or have 40% equity in their home when refinancing. The extremes of what combinations are allowed are the top left corner (best) and bottom right corner (worst).

Just understand that the best rates quoted are assuming excellent credit, a large down payment or equity and no other negative loan characteristics.

Get a Custom Rate Quote

3. Variables Needed For an Accurate Rate Quote

Because of these price adjustments made by lenders to offset the risk associated with each loan, in order to get an accurate mortgage rate quote for a loan that you will qualify for, you will need to provide the following:

- Your credit score (or best estimate)

- Occupancy (primary residence or rental property)

- Purchase Price or Estimate Value

- Loan Amount

- Loan Type Requested (fixed or adjustable)

- Property Type (SFR, condo, 2-4 units)

- Transaction Type (purchase or refinance)

- Documentation Type (full or stated)

We all want to get information quickly on the best mortgage rates, but be careful of posted ads and online quotes where the above characteristics are not factored in because the quotes will be worthless since they are not unique to your situation. Be patient and make sure when you compare mortgage rates, that these variable are accounted for and included in any quotes you receive.

I know that is a lot of information, but just keep it simple when shopping for the lowest mortgage rates. Get the Fees Worksheet which lists all of the fees and monthly payments required, understand there are different rates based on the above listed variables and request an accurate rate quote specific to your situation.

And if you are serious about getting a new loan, it’s ok to look at the general market rates, but start thinking about how much you need your payment to be and what type of fees, if any you are willing to pay to get that loan.

My team is always happy to provide you with several detailed options on loans that you will qualify for and insure that you have all the information you need to make a decision.

Are you ready for a custom loan quote? Call us at 800-607-1941.

Posted by: Brian Bush

Posted by: Brian Bush

Brian and his team have been funding Real Estate Loans for over 25 years.

Since 1991, they have funded over 1.5 Billion Dollars in loans.

You can reach Brian at 800-607-1941 x220 or bbush@slglends.com

[wpdm_package id=’2489′]

[wpdm_package id=’2490′]