Are you looking to make your first home purchase, but worried that your credit may stop you?

Well, you are not alone. You are not the only first time home buyer with bad credit. Most new homeowners using our loan programs have had some credit issues.

Reduced credit requirements (lower credit scores allowed, smaller down payments, etc.) allow us to issue loan approvals to those who will not qualify for traditional loans.

I know you are wondering…how bad can my credit be?

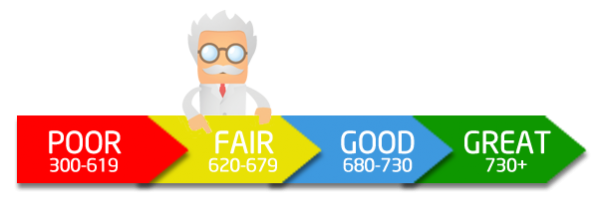

We allow lower credit scores (below 600 credit scores) and shorter waiting periods since major credit events like, bankruptcy, foreclosure and short sales, some recent late payments and collection accounts.

I am sure that you are thinking that you will need a large down payment to qualify, right?

Wrong. These programs allow for a less than 5% down payment.

Last year, the national average Fico credit score was 711, according to Experian. So, you can have a score well below the national average and still get approved for a mortgage with these new programs.

You probably already know that the big banks don’t like these loans. Most big banks have a minimum credit score requirement of 720 or higher and won’t approve a loan for a first time home buyer with bad credit.

Even though you may have a long-standing relationship with a big bank, if your credit is not perfect, they are likely to decline your home loan request. Regulators and most bank shareholders want to stay away from lower credit score loans to avoid the risk.

But, there are companies, like ours who represent some of the largest wholesale mortgage banks in the nation that love these loans, even specialize in them.

Our loan pre-approvals are fast. In just two business days you can get your written loan pre-approval.

It’ simple. You don’t need great credit or even a large down payment to qualify. And there is no better time than now, before home prices and interest rates creep up.

So, what are you waiting for?

Are you ready to see what these new mortgage programs can do for you?

Posted by: Brian Bush

Posted by: Brian Bush

Brian and his team have been funding Home Loans for over 28 years.

Since 1991, they have funded over 3,000 loans

You can reach Brian at 800-607-1941 x220 or bbush@slglends.com